Ask the advisors: Is tax-loss harvesting common practice?

Though not a novel concept, tax-loss harvesting has received increased public attention over the past few years. On one hand, it’s considered an excellent tactic for minimizing tax liabilities. On the other hand, it requires careful consideration, planning, and knowledge of the rules to ensure the losses can be claimed.

Is the risk too great for the reward? Are financial advisors throughout the industry capitalizing on this practice, or does the complexity prevent them from incorporating it into investment strategies?

We asked and the financial advisor research community answered

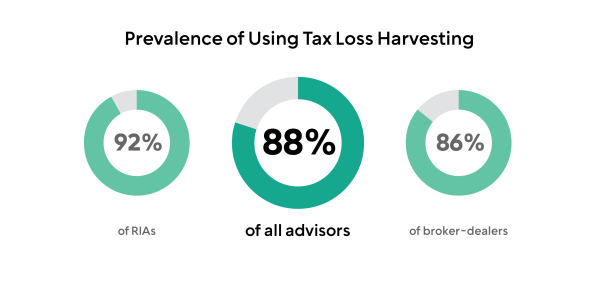

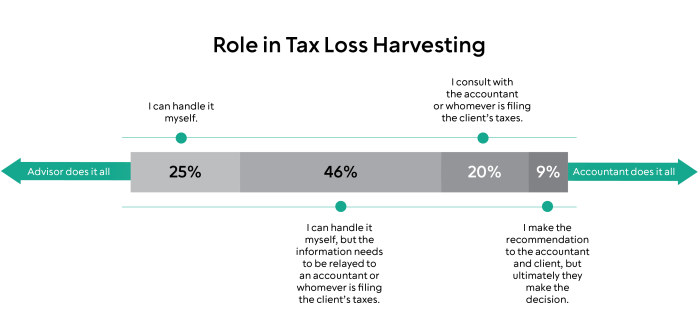

With access to hundreds of financial advisors across all channels, we turned to our online research community to get a pulse on the prevalence of this practice. In just three business days, 461 financial advisors weighed in, and we had a verdict: Most advisors are taking advantage of tax-loss harvesting to benefit their clients.

Additionally, many of them bear much of the decision-making and tax reporting themselves.

Top five reasons advisors don’t use tax-loss harvesting, according to Bellomy’s AI Assistant

If so many experts in the industry use this tactic, what holds others back? Armed with unstructured responses from those who don’t utilize tax-loss harvesting, Bellomy’s AI assistant generated the following top themes in only a handful of seconds:

- “Don’t have enough time.”

- “Don’t understand it.”

- “Confuses clients.”

- “Lack of interest.”

- “Not worth the effort.”

These results suggest that advisors who are hesitant to employ tax-loss harvesting may need additional resources or support to reap the same benefits as others in the industry.

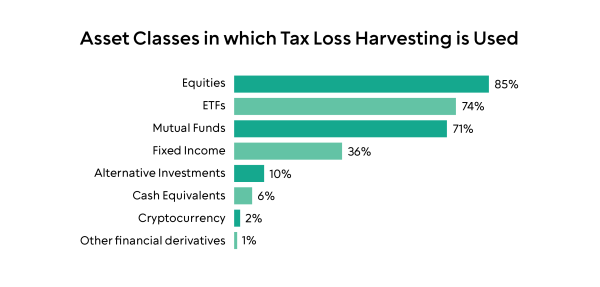

Do cryptocurrencies have skin in the tax-loss harvesting game?

Despite the growing acceptance of investing in cryptocurrencies, tax-loss harvesting with those assets was reported at a surprisingly low rate.

Is this an area of opportunity, or are advisors wary of this volatile territory? We might have to dig into the online research community about that one next.

Get a pulse on industry practices through the financial advisor online research community

Understanding your own advisors is important, but it’s equally as important to understand what others in the industry are doing. Bellomy’s proprietary research community consists of more than 1,000, hard-to-reach financial advisors ready to answer your most pressing — even time-sensitive — questions. Whether it’s a short poll or AI-driven analysis on open-end responses, we have the tools and industry professionals to unearth cutting-edge, relevant insights in a matter of days.

Justin Bailey, Director of Strategy

Justin Bailey, Director of Strategy

Justin leads the financial services team at Bellomy, helping clients diagnose business challenges and transform them into successes. He's worked with professionals from financial advising firms, fintech providers, and banking institutions to understand needs and design research approaches that produce actionable insights.