What mortgage lenders should know about their evolving customers

Home sales have been on the rise over the past year, and those sales and loans are not expected to slow any time soon. Our research shows that as of November, two-thirds of the population had not bought a new home, financed, or renovated in 2020. Combined with interest rates hovering around all-time lows, there’s a good chance one of these could be in many of their futures.

Home sales have been on the rise over the past year, and those sales and loans are not expected to slow any time soon. Our research shows that as of November, two-thirds of the population had not bought a new home, financed, or renovated in 2020. Combined with interest rates hovering around all-time lows, there’s a good chance one of these could be in many of their futures.

However, this research also suggests that the loan process is particularly challenging for a prime group that is changing the way they think about homebuying: Generations Y and Z. Additionally, compared to mortgage company customers, more bank customers overall have reported feeling as though they are struggling to get assistance from their lenders during the pandemic. Together, these point to an invaluable opportunity to start meeting the next generation of homebuyers where they want (and need) to be met.

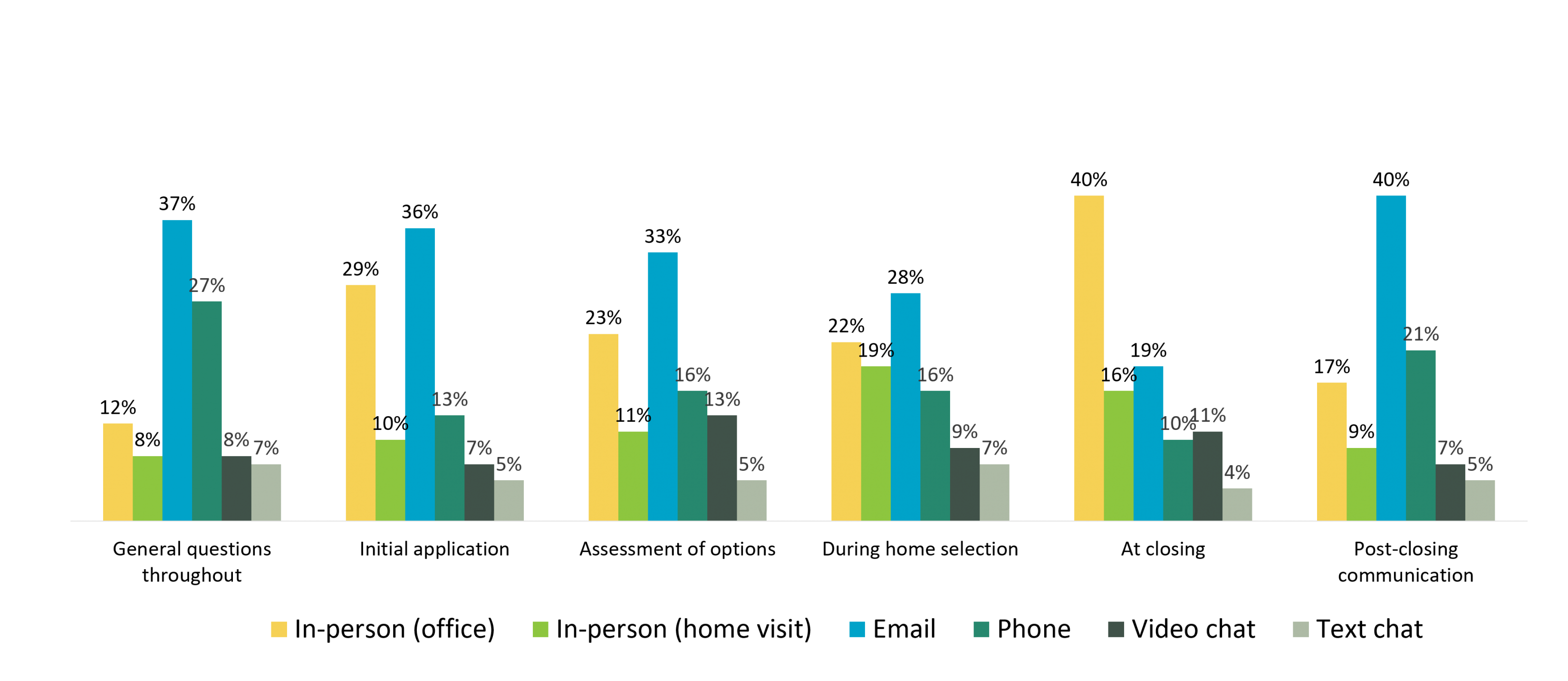

Finessing touchpoint communication

Each individual touchpoint on any given journey represents a customer need and a business's opportunity to address that need. We’ve identified and evaluated the following as critical touchpoints along the homebuying journey:

-

General questions and inquiries

-

Initial application

-

Assessing options

-

Home selection

-

Closing

-

Post-closing communication

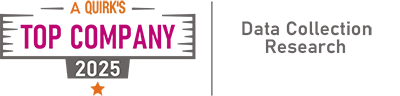

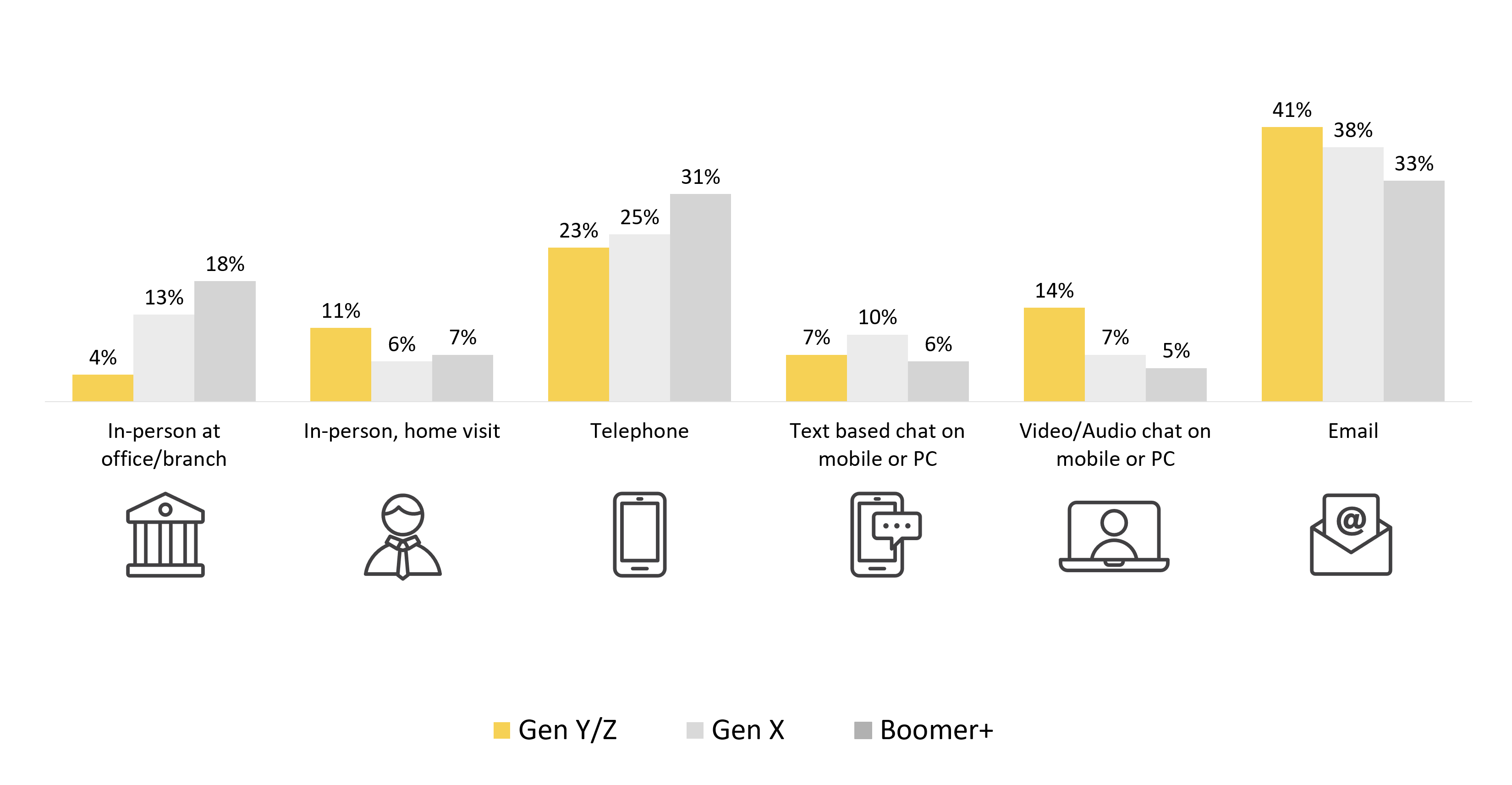

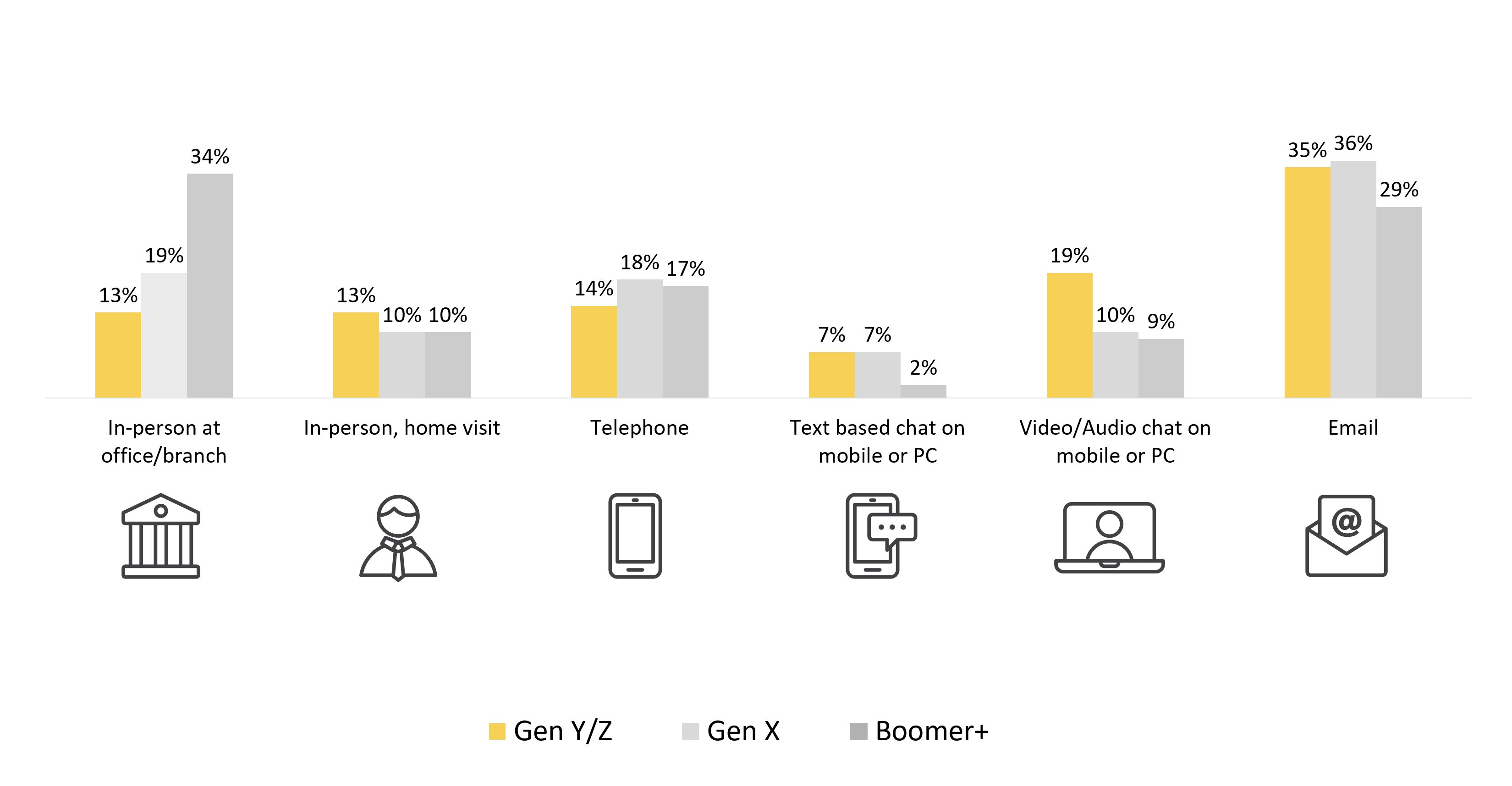

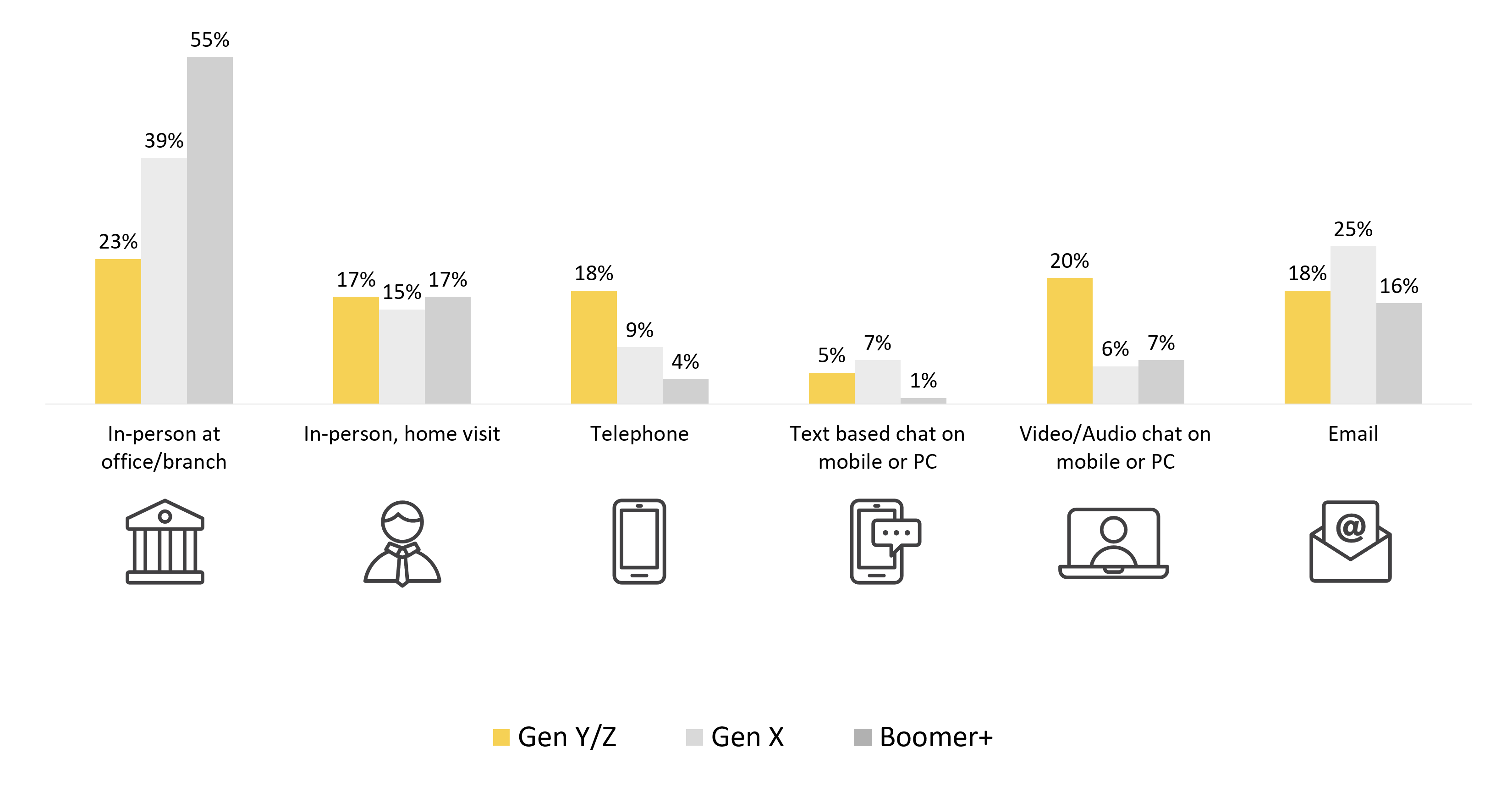

When broken out by generation, we're able to see that Gen Y/Z has the strongest preference for digital communication methods compared to their Gen X and Boomer counterparts. With channels like text and video chat emerging alongside email, younger generations are becoming more accustomed to engaging remotely, whether due to convenience, safety concerns, or a combination of both.

Preferred method of communication — General questions and communication throughout the process

Preferred method of communication — Assessing options

Preferred method of communication — During home selection

One size does not fit all

The way you engage and interact with customers at each touchpoint may vary by lender or customer, but the mortgage loan process has always been fairly traditional, in the brick-and-mortar channel. While there’s a clear group driving the shift to digital, it’s gaining traction among Gen X and Boomers as well: two-thirds of Gen Y/Z and 59% across all generations said they would move to a 100% contactless loan process if it were made available to them. When given a choice between communicating in person, over email, by phone, or by video or text, email was the overall most preferred communication method at every touchpoint except one: at closing.

Overall preferred method of communication

However, among Gen Y/Z, the in-person preference at closing is much less dramatic, with mixed preferences across most of the communication channels.

Preferred method of communication — At closing

Keeping up with customers by going omnichannel

Thus, despite preferences pointing to a more digital future, some buyers still want to sign papers and seal the deal in person. This shows that a one-size-fits-all approach to communicating and working with customers does not suffice and your strategy should depend on customers’ needs at a given point in time. Though it may seem like it’s been a long time coming, the pandemic has expedited the need for adopting an omnichannel approach.

Breaking down the process and looking at individual touchpoints allows you to provide more efficient service and personalized experiences to support your customers. It all comes down to knowing who they are and how you can cater to them, allowing you to optimize their experience from start to finish.

We have more insights on how the pandemic is accelerating the adoption of an omnichannel CX approach within the financial industry. Watch a comprehensive presentation of the research findings and download the full report now.

We have more insights on how the pandemic is accelerating the adoption of an omnichannel CX approach within the financial industry. Watch a comprehensive presentation of the research findings and download the full report now.

We've been keeping a pulse on survey respondents since the start of the pandemic. They are members of our proprietary panel that reflects the country’s demographic makeup. In the seventh wave of our monthly COVID-19 pulse research, we surveyed more than 1,000 respondents to understand the impact of the pandemic on the homebuying and refinancing experiences.

- covid-19