Pandemic fueling the digital transformation

It’s still early, but there's one clear pattern emerging: consumers are staying home and transacting online more than ever before.

Acceleration of the digital transformation

In fact, in our recent survey collected among 1,110 consumers across the US, we are seeing an acceleration of the digital transformation that has been occurring over the past decade. While usage of digital and online features has increased among consumers over the past several years, many people have been slow to adopt, preferring in-person visits instead. However, now that people are being asked to stay home, many of these resisters are trying online shopping, banking, and other features for the first time. The result: they like what they see and plan to continue these behaviors, even after coronavirus-related travel bans have been lifted.

In fact, in our recent survey collected among 1,110 consumers across the US, we are seeing an acceleration of the digital transformation that has been occurring over the past decade. While usage of digital and online features has increased among consumers over the past several years, many people have been slow to adopt, preferring in-person visits instead. However, now that people are being asked to stay home, many of these resisters are trying online shopping, banking, and other features for the first time. The result: they like what they see and plan to continue these behaviors, even after coronavirus-related travel bans have been lifted.

For example, 31% of our US-representative sample indicated that in the past few weeks they have used digital or online banking methods for the first time to avoid in-person visits. They are opting for online funds transfers and depositing checks on their bank’s mobile app rather than going to the branch to conduct their business. What’s more, when asked if they are likely to continue using these features once things settle down, nearly 9 in 10 said they would do so! This means a whole new group of consumers is now being exposed to digital banking, and they don’t plan to stop anytime soon.

The same findings are true across other industries as well. For grocery 29% of consumers report they will purchase online, compared to 24% who said they were doing this earlier in the year prior to COVID-19's assault on the United States. Online apparel purchasing has increased from 29% in Q1 2019 to 36% since the COVID-19 travel ban, and if you account for those who are delaying apparel purchases, over 70% are using online channels. These findings are supported by other research released in the past week as well: across the board, online and digital transactions are up, many times from people who have yet to try online shopping, and most report that they will continue doing this even after the coronavirus restrictions are removed.

It may not be who you think it is

Even potentially more interesting about these data is who comprises the 31% that are shifting their banking behaviors. Many commonly generalize that digital native Millennials are heavy users of online and digital technologies. However, our research shows that Millennials, along with high earners ($150k+) and Hispanic households, are the demographic groups shifting their banking behaviors. In fact, 40% of Millennials said they have tried an online banking feature for the first time during the coronavirus pandemic, and 89% of that group said they would continue using these features. Similarly, 39% of Hispanics say they have tried a feature for the first time. While these two groups both over-index on trying online banking features for the first time, high earners show the biggest change: 54% of those who make $150k or more per year have tried an online feature for the first time. Nearly half have transferred funds online, while 35% have deposited a check with their smartphone for the first time.

Preparing for a behavior shift

This rapid and overwhelming adoption is good news for companies with an online presence. These digital resisters are satisfied enough with their experience to resoundingly suggest that they have now incorporated these digital experiences into their normal routines. This doesn’t appear to be a one-time, temporary solution while we are being asked to stay at home, but rather the adoption of digital tools meant to make it easier for the consumer (and often to save companies time and money). This means it is more important than ever to make sure your digital and online tools meet your customers’ needs.

This rapid and overwhelming adoption is good news for companies with an online presence. These digital resisters are satisfied enough with their experience to resoundingly suggest that they have now incorporated these digital experiences into their normal routines. This doesn’t appear to be a one-time, temporary solution while we are being asked to stay at home, but rather the adoption of digital tools meant to make it easier for the consumer (and often to save companies time and money). This means it is more important than ever to make sure your digital and online tools meet your customers’ needs.

Customers who trust your brand need to be assured that they can go online and easily do everything they need and that their information and data will be kept private and secure.

Their loyalty could wane if their digital experience doesn’t meet their needs. Customer experience and user experience testing can ensure that this new wave of digital adopters — likely those who are most resistant to this form of interaction — will continue using your brand both now and in the future.

Secondly, a shift away from in-person shopping and banking could mean less social interaction and a need to approach customer engagement differently. As the interaction shifts from in-person to online, so must the engagement, and companies will need to continue to adapt. Grocery stores and other retailers will need to consider long-term delivery and pick-up strategies, while banks will need to prepare for fewer in-person visits.

As we continue to experience the impacts of a near-global shutdown in real time for the first time, we must be ready to adapt to how COVID-19 will shape and change us. Some of these changes will be temporary and we’ll return to “normal” sometime in the near future, while others will have a lasting impact. Our data shows that the slow-moving digital transformation has been accelerated by necessity over the past few weeks, and those with a long-term digital strategy in place will likely grow and adapt more quickly than their competitors.

- covid-19

- digital transformation

Topics

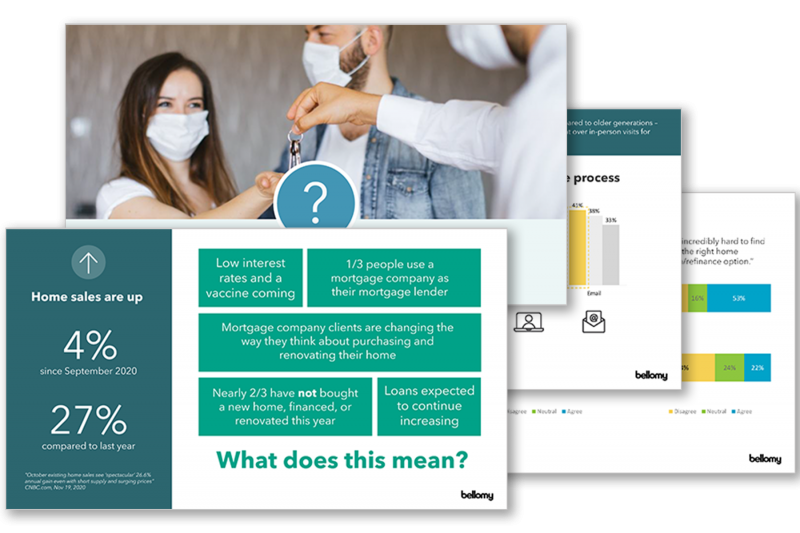

The Future of Mortgage Lending

The Future of Mortgage Lending

Hungry for more? We have additional insights on how the pandemic has been accelerating the need for an omnichannel approach to CX management. Get the full Pandemic Impact on the Future of Mortgage Lending report and presentation at your fingertips today.