Strategic insights for optimal brand health and performance

In today’s competitive market, strong brand health is crucial for any company striving for success. Brand health measures provide a comprehensive evaluation of a brand's health and its effectiveness in achieving business goals. By understanding the diverse aspects of brand health, businesses can make informed decisions and drive sustainable growth. Maintaining brand health requires a strategy supported by market research and advanced technology. Brands that effectively measure, analyze, and adapt their strategies based on data-driven insights position themselves to sustain their market presence, deepen their connections with consumers, strengthen brand resilience, and achieve long-term growth.

What is a brand?

A brand is the cohesive whole of a collection of elements. Many of these elements are obvious and instantly recognizable to us, the consumer — brand name, logo and visual identity, message and voice, and even the brand's reputation and values. However, other elements of a brand are perhaps less obvious to the average consumer: brand promise, brand experience, brand equity, brand positioning, and brand story.

The brand’s job is to put a unique stamp on an often quotidian product or service so that it stands apart from the rest in the hearts and minds of consumers. Put in the context of shoes, it’s down to the brand to conjure Vans from canvas slip-ons, Jordans from high tops, and Crocs from colorfully perforated plastic pontoons.

A brand represents specific qualities that consumers associate with a product or service. It represents an implicit agreement with consumers about said product or service. It’s the embodiment of all interactions, perceptions, and associations that customers have with that product or service. Satisfied customers not only become brand advocates but also actively promote the brand through social networks, contributing to overall brand awareness. Healthy brands translate to strong customer loyalty, opportunities for premium pricing, and competitive advantage. With so much riding on the brand, monitoring its health is a strategic imperative.

What makes a healthy brand?

Brand health is tied to the brand’s, or company’s, relationship with customers. Assessing and measuring the brand’s health involves understanding how well the brand is performing in relation to its promises to customers. Typically, the more customers are satisfied with a product or service and have positive experiences during interactions related to the brand, the better the brand’s health.

Here’s how Rob Rush of Deloitte & Touche LLP has explained it: “The closer a customer experience is to the brand promise, the healthier the brand.”

Healthy brands engage with consumers across various channels, proactively track the state of their category and potential competitive threats, and update or refresh their products and services in alignment with customer needs and wants. These behaviors help brands remain relevant and competitive in a dynamic market landscape yielding a robust and positive brand reputation.

[Ready to learn more about the health of your brand? Get in touch!]

Assessing brand health: brand health metrics

Understanding a brand’s overall health is critical for businesses aiming to retain existing customers and increase penetration in their respective categories. To effectively track brand health, businesses need to employ a variety of metrics beyond just financial indicators. Brand health metrics are essential indicators for assessing the overall health of a brand. Understanding key brand health metrics is crucial as they provide valuable insights into a brand’s strengths and weaknesses, which can ultimately enhance business performance. Brand health assessment requires analyzing an aggregate of key metrics that will vary depending on research objectives. That said, the following are among the most common.

Brand awareness

Brand awareness is an individual’s knowledge of a product’s existence. It’s a key predictor of brand health and is the foundation of many brand metrics. Purchase intent is a key metric derived from surveys that measures how likely consumers are to buy from a brand.

Related measurements include:

- Recall is the ability to remember a brand without prompts or cues; recall implies a stronger connection than recognition.

- Top-of-mind awareness (TOMA) is the holy grail of brand recall. It signifies that a brand is the first to come to mind when a consumer thinks about a particular product category. TOMA is also a key indicator of brand loyalty and an important measurement overall when assessing brand health.

These metrics are traditionally measured with surveys and polls designed to assess recall, recognition, and comparisons with competitive products.

Brand loyalty and brand reputation

Customers who consistently buy the same brand product/service over a sustained period demonstrate brand loyalty despite factors like competition and price changes. Evaluating a brand's reputation is crucial as part of assessing overall brand health, as it significantly influences customer loyalty and advocacy. A high rate of brand loyalty develops over time through repeated positive experiences. Monitoring brand loyalty is essential to avoid the potential risk of overestimating customer commitment.

A few common measurements of brand loyalty are:

- Repeat purchase rate: The percentage of customers who purchase the brand product over a certain period.

- Customer retention rate: The percentage of customers who remain with a brand over a specific period.

- Net Promoter Score: A quantifiable measurement of customer loyalty and satisfaction based on the likelihood a customer will recommend the brand product to others.

Customer feedback, longitudinal panel data, and sales and loyalty program data often inform these metrics.

Market share – a measure of brand health

Analyzing market share lets a business gauge its competitive position and identify and adapt to changing market dynamics. Market share is often measured using survey and sales data.

A rising market share commonly signifies increasing consumer preference, which usually correlates with stronger repeat purchase metrics. Typically, premium brands exhibit a higher revenue share despite smaller unit sales, while value products demonstrate the opposite dynamic.

Customer satisfaction

Customer experience and satisfaction are crucial for long-term brand health, as many metrics are closely tied to these aspects. Measuring brand health through various methodologies such as customer feedback and social listening is essential for understanding a brand's effectiveness in achieving business goals. Satisfaction metrics gauge post-use perceptions, which correlate strongly with repeat purchases and positive word-of-mouth. Achieving high satisfaction requires meeting consumer needs and offering distinct benefits.

When satisfaction falters, the repercussions can be severe, starting a self-fulfilling cycle of poor brand health. Negative feedback reduces the potential for future purchases, leading to decreased sales. Retailers may then de-list products, further diminishing market share and repeat opportunities. By the time companies recognize the problem, it can be too late. This is why constant customer satisfaction monitoring is essential for maintaining a healthy brand.

Customer satisfaction measures how well a brand meets customer expectations across various dimensions. Common metrics include overall satisfaction, product/service quality, and attitudes towards brand attributes. Traditionally, brands use consumer satisfaction surveys to measure these, but social media and review sites also provide valuable feedback. Given the complex nature of measuring consumer feedback, Bellomy’s developed a comprehensive analytical toolkit that includes ‘voice of consumer’ metrics, satisfaction surveys, NPS tracking, and more to analyze customer feedback thoroughly.

Brand equity

Brand equity is a crucial component of brand health that reflects consumers’ perceptions and experiences with a brand. Tracking it is essential as it provides a distinct approach to measuring a company's performance, separate from financial metrics like sales figures. It is built over time through consistent positive interactions and shapes a favorable brand reputation in consumers’ minds.

Key aspects of brand equity include:

- Recognition and loyalty: As brand equity grows, it increases a brand's potential to generate sales and foster customer loyalty.

- Perceived quality: Consumers' perception of a brand's quality contributes significantly to its overall equity.

- Market advantage: High brand equity leads to greater customer loyalty, resulting in repeat purchases and word-of-mouth referrals.

- New product introduction: Brands with significant equity can more easily introduce new products due to established trust and recognition.

Components of brand equity measurement: brand health metrics

- Brand perception: This measures how consumers view aspects like brand quality and value.

- Brand associations: This evaluates how well consumers connect core brand assets (imagery, logos, advertising styles) to products.

Measurement methods:

- Traditional surveys: These can capture brand attitudes through perceptual questions.

- Sentiment analysis: Ongoing monitoring of online and social media channels can track real-time consumer opinions and their impact on long-term equity.

By understanding and measuring these aspects of brand equity, companies can better assess their brand's overall health and make informed strategic decisions to maintain and improve their market position.

Market research methodologies to measure brand health

Because brand health comprises multiple, diverse elements, accurately capturing a complete picture of it requires a holistic approach that can include a combination of methodologies.

Focus groups and consumer surveys: These methods involve gathering a group of consumers to discuss their perceptions and feelings about a brand. Focus groups provide deep insights into consumer attitudes and behaviors, while surveys can reach a broader audience to better understand key attributes and quantify results. This data is essential for understanding the emotional connections consumers have with a brand, identifying pain points, and uncovering opportunities for improvement.

Social listening: This involves monitoring social media platforms and other online channels to understand what consumers are saying about a brand in real time, organically and without prompting. Social listening tools analyze conversations, mentions, and sentiments to provide insights into consumer opinions, emerging trends, and potential issues.

Net promoter score: NPS is a measure of customer loyalty and satisfaction. It’s based on responses to the question of how likely the customer is to recommend the product/service to friends and colleagues on a scale of 0 to 10. Responses place customers in categories of promoter, passive or detractor, with NPS calculated by subtracting the percentage of detractors from the percentage of promoters.

Customer satisfaction score: CSAT scores gauge overall customer satisfaction with a brand’s products or services. This metric is important because it provides a quantifiable measurement of key indicators of brand health: customer loyalty and satisfaction. Typically this information is collected survey style, with customers asked some version of “How satisfied are you with [product/service]?” Respondents rate their satisfaction on a scale, often 1 to 5, with 1 indicating dissatisfied and 5 indicating very satisfied.

Key driver analysis: KDA is a statistical technique used to identify the factors (drivers) that most significantly impact an outcome of interest, often customer satisfaction or loyalty. This is valuable to a business because understanding the most influential elements of a product/service allows them to adjust priorities and direct resources and efforts to areas with the greatest effect. Successfully applied, resulting initiatives should have a positive effect on brand health.

Gap analysis: For our purpose, this involves comparing a brand’s performance against competitors across attributes like product quality, customer service, pricing, and brand perception. This type of analysis identifies how a brand is performing relative to competitors, highlighting areas that need improvement and opportunities to gain a competitive advantage.

Identifying these gaps is critical for strategic planning, resource allocation, and meeting goals. Ideally, companies use these insights to rebalance and address weaknesses, resulting in strengthened brand positioning.

[Ready to assess the health of your brand? Get in touch!]

Leveraging advanced technology for brand performance

With the growth in machine learning and artificial intelligence, the analytical toolkit available to brand strategists has significantly expanded. These tools enable robust tracking and accurate predictive analysis, helping you monitor performance and anticipate trends with greater agility. Integrating these technologies into traditional market research gives brands a more comprehensive approach to measuring brand health.

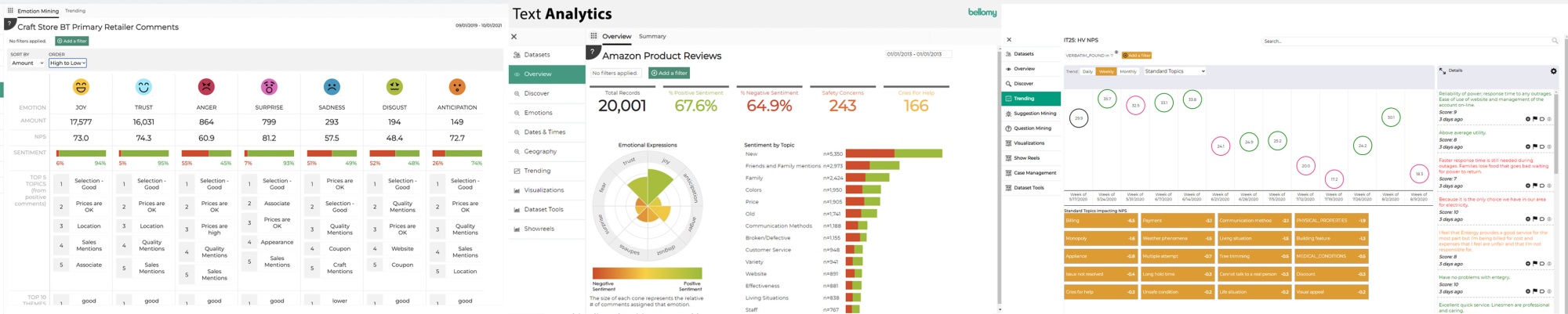

The Bellomy Research Cloud brings all of this together and centralizes these advanced capabilities into a single, cohesive platform. It allows you to leverage those capabilities to develop a customized dashboard tailored to your brand. This integration ensures that all relevant metrics are tracked simultaneously, providing a complete picture of your brand’s health. This technology stack is powered by machine learning to store and analyze datasets, view performance dashboards, and generate predictive analytics that can power your brand forward.

Brands also continue to emphasize agility, which our dedicated research team understands. That’s why our Research Cloud provides the flexibility to develop customized dashboards and generate in-the-moment insights as needed by your stakeholders.

Beyond capabilities like this, recent advancements in artificial intelligence have unlocked new possibilities elsewhere as well. AI analyzes vast, complex datasets swiftly and accurately, uncovering hidden patterns that can help better understand consumption habits. This enables businesses to predict consumer behavior and respond to market trends with greater agility. Whether refining audience segmentation or conducting real-time sentiment analysis, AI enhances every phase of market research, leading to smarter decision-making.

Bellomy’s AI Analytics for Text: Our team has expanded our advanced capabilities further with the launch of our AI Analytics for Text tool. This innovative solution combines the latest in NLP (Natural Language Processing), artificial intelligence, and AI-driven topic modeling to mine datasets for trends, opportunities, and actionable recommendations that drive growth.

The tool was designed by our leading team of market researchers and technologists with real-world research workflows and demands in mind. Unlike many other AI-related research tools, this model is customizable, which allows researchers to apply custom topics from one dataset to another or change the way they look at data depending on the specific objectives of a given project. Most importantly, the tool is accessible through the Bellomy Research Cloud, which allows easy integration with your projects and datasets.

Brand health at Bellomy

At Bellomy, we take a holistic and detailed view of your customer base and category. Our team utilizes advanced analytics to uncover the drivers of brand consideration and conversion, both for you and your competition. By identifying your key organizational strengths and weaknesses, we help you build on your successes and address any challenges, ensuring your brand remains competitive and poised for success.

Case Study 1: Customized brand tracking for the restaurant industry

Business challenge: A quick-service restaurant (QSR) chain expanding across North America needed to understand its brand health and track key metrics for itself and its competitors, having never engaged in brand health research before.

Bellomy solution: Bellomy developed a customized approach to brand health tracking, combining in-store observations, quantitative health surveys, and social media listening. We created a tailored questionnaire with industry-specific metrics, conducted ongoing surveys to measure awareness, usage, and brand perceptions in key markets, and performed key driver and gap analyses. All results were integrated into the Bellomy Research Cloud, providing real-time data tracking, crosstab analysis, and data visualization capabilities.

Business outcome: The client gained a comprehensive understanding of their brand health at any given time, with access to detailed insights reports, real-time data tracking, and the ability to perform cross-wave comparisons. This enabled them to identify competitors' strengths and weaknesses, understand the importance of measured attributes, and make informed strategic decisions to guide their future growth across North America.

[Ready to learn more about the health of your brand? Get in touch!]

Case Study 2: Enhancing category insights for a national department store

Business challenge: A national department store needed a category-level understanding of the equities and market forces that drove customer decision-making and purchase behaviors across their competitive set.

Bellomy solution: Bellomy designed a comprehensive survey and integrated social listening to inform KPI trends. Differentiated Key Driver Analysis identified the most influential equity drivers across target segments, and a gap analysis provided relative competitive performance. We developed monthly dashboards in their Bellomy Research Cloud and prepared quarterly deep-dive reports to review with stakeholders and provide recommendations.

Business outcome: Through our timely Cloud-based reporting and analytics and Bellomy’s consultative perspective, our client has communicated being able to anticipate emerging needs more effectively and develop more informed strategic decisions.

[Ready to learn more about the health of your brand? Get in touch!]

Case Study 3: Streamlining insights for a major grocery retailer

Business challenge: A major grocery retailer was unable to keep up with the demand for insights from their stakeholders by exploring each through individual studies. They didn’t have the resources or budget to fulfill all these requests without a more agile and cost-effective approach and asked Bellomy for a viable solution.

Bellomy solution: Bellomy developed a 1,300-person online research community of the grocer’s database customers to provide readable samples across regional, demographic, and other relevant groups. Bellomy provided end-to-end study management while creating an integrated Research Cloud that allows them to review, analyze, and report on study data at any time during its progress.

Business outcome: The community replaced traditional product testing and focus groups, providing accelerated learning and driving faster optimization to get to market sooner. The product was successfully launched nationwide and became a strong competitor in the emerging category.

Looking ahead

As markets evolve and consumer behaviors shift, the importance of maintaining strong brand health will only increase. Companies that invest in comprehensive brand health strategies and leverage advanced analytics will be better positioned to:

- Anticipate and respond to changing market dynamics

- Develop more targeted and effective marketing campaigns

- Foster stronger connections with their target audience

- Outperform competitors in their respective industries

By prioritizing brand health and embracing innovative research methodologies, businesses can build resilient brands that thrive in today's competitive landscape and are prepared for future challenges and opportunities.

If you're facing a brand health challenge or want to ensure your brand remains strong and competitive, we’re here to help. Get in touch at bellomy.com/consultation.